What is the federal funds rate?

The federal funds rate is the target interest rate range that banks charge one another for borrowing money. The rate then affects consumers because it will also impact the interest rates they pay on loans, such as car loans, HELOCs and other debt like credit card rates.

The Fed officials announced on May 1, they will continue to hold rates steady this month, keeping the target range at 5.25% to 5.50%.

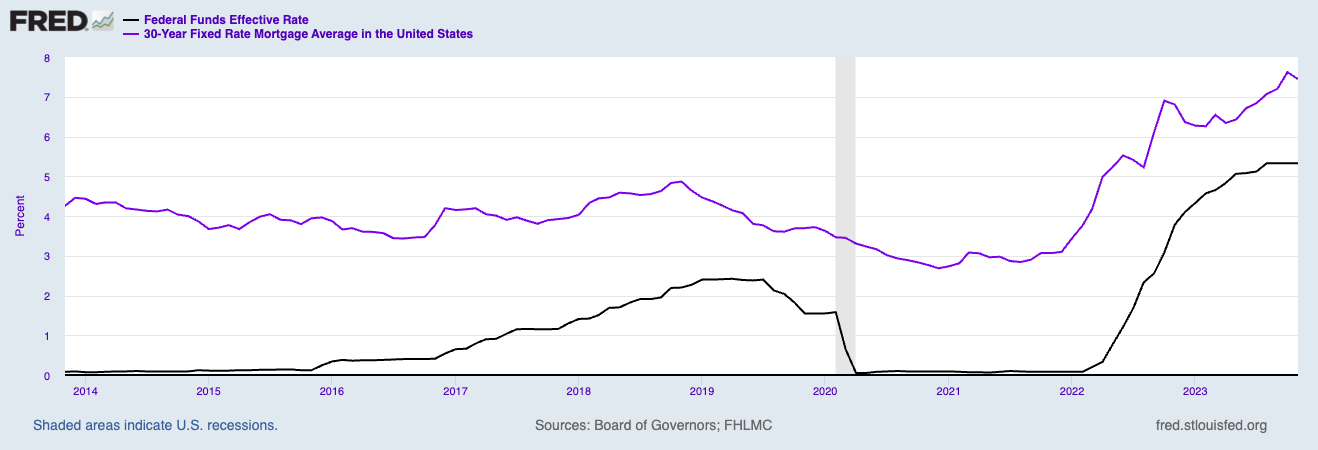

Today’s rates are a big departure from just a few years ago. Back in March 2020, the federal funds rate sat at near zero, and in June 2021 policymakers predicted there would be no rate hikes in 2022.

However, the Fed has increased the federal funds rate 11 times since then in an effort to combat inflation.

Don't miss

- Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

- Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

- These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

Understanding the federal funds rate

The federal funds rate is dictated by Federal Reserve officials, specifically a 12-person committee — called the Federal Open Market Committee (FOMC) — that includes the chair of the Reserve, Jerome H. Powell. The FOMC meets eight times a year to discuss the rate, using indicators such as inflation to determine whether a hike is necessary.

The Fed interest rate hike, or funds rate hike, is meant to limit consumer demand. When the rate increases it indirectly affects the interest that consumers pay for loans, such as those used to buy a car or buy a house.

Inflation was at 3.5% as of May 2024.

How the federal funds rate impacts borrowing

Mortgages

The federal funds rate helps dictate the prime rate and variable mortgage rates, though not the rates on fixed home loans. Even so, new fixed-rate loans have been getting more and more expensive.

During the earlier stages of the pandemic, the Fed kept fixed mortgage rates in check by buying billions worth of Treasury bonds and mortgage-backed securities every month. Those purchases helped "foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses," the central bank said.

But in May 2022, the Fed announced plans to begin selling off some of those assets.

The federal funds rate more directly affects other forms of borrowing, such as credit cards and car loans.

The federal funds rate and avg 30-year mtg rate, last 10 years

Credit cards

The interest rate hike also affects the interest you pay for credit card loans. The annual percentage rate (APR) determines how much you pay for any debt that is outstanding at the end of the month. The average APR has increased from 16% prior to 2022's first hike to 27.90% as of May 1, 2024.

What does this mean for your credit card payments? Someone with a $15,000 credit card balance will now pay over $700 more in interest (compared to an APR of 16%).

Car loans

In the last quarter of 2022, the national average rate for a 60-month new car loan was 5.50% but that has increased with each rate hike. The average 60-month car loan rate sits at 8.22% as of February 2024, according to the Federal Reserve latest data.

However, keep in mind that factors such as credit score and vehicle type will affect your given rate.

HELOCs

Home equity lines of credit are also tied to the federal funds rate, although there is a less direct link. The interest rate for a HELOC is determined by the prime rate, which is usually 3% higher than the federal funds rate. Since HELOC lenders tie their rates to the prime rate, users with a variable rate HELOC will see their interest payments go up or down based on the federal funds rate.

When the federal funds rate increases, HELOC interest typically increases by the same amount. For a 10-year $30,000 HELOC, the average rate is 9.10% as of May 2024.

Discover How a Simple Decision Today Could Lead to an Extra $1.3 Million in Retirement

Learn how you can set yourself up for a more prosperous future by exploring why so many people who work with financial advisors retire with more wealth.

Discover the full story and see how you could be on the path to an extra $1.3 million in retirement.

Read MoreWhat to do when interest rates go higher

If a mountain of nagging, high-interest debt has you worried, you could roll those debts into a single, lower-interest debt consolidation loan. You’ll pay less in interest, and potentially eliminate your debt sooner and free up some cash flow.

Before applying for any type of loan, take a quick, free peek at your credit score. Borrowers with the highest credit scores are typically offered the lowest rates, so you may need to work on improving your score before you approach lenders.

If you're planning to buy a home anytime soon, it's probably time to lock in a mortgage rate, as both adjustable and fixed-rate mortgages are getting more expensive with each rate hike. The bigger the purchase, the more your interest rate matters.

Whatever type of home loan you’re shopping for, be sure to compare offers from at least five lenders. Evaluating multiple offers is a proven strategy for finding the best mortgage for your budget.

What to read next

- Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today), no matter what the US Fed does or says

- Jeff Bezos and Oprah Winfrey invest in this asset to keep their wealth safe — you may want to do the same in 2024

- Stop crushing your retirement dreams with wealth-killing costs and headaches — here are 10 'must-haves' when choosing a trading platform (and 1 option that has them all)