What is payment for order flow (PFOF)?

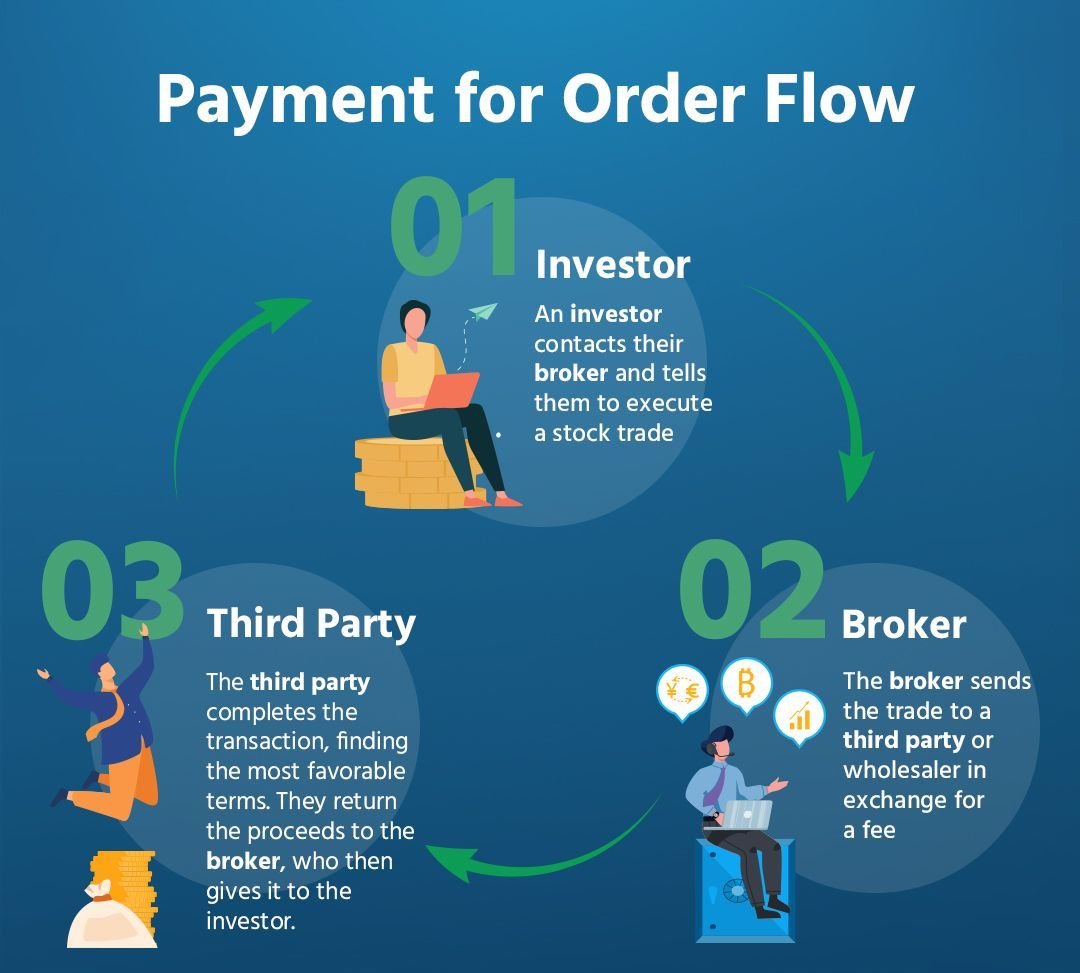

Payment for order flow (PFOF) refers to a practice where a stock broker receives compensation for routing an order to a particular market maker. In other words, it means your broker is getting paid to process your trades though a certain third party.

When you normally place a trade, your broker works with a clearing fim to route the order. This ensures that your order is actually processed properly and the correct trading info flows between broker, market maker, and the exchange.

This can be a complex concept to understand, so here’s an example:

Let’s say you want to sell 100 shares of Stock X, so you log into your brokerage or stock trading app and enter an order to sell 100 shares. If your brokerage participates in PFOF, the sale may not go right to the New York Stock Exchange or Nasdaq. Instead, a middleman company will quickly analyze the transaction to decide if it can profit from the order by managing the trade on its own.

If someone else out there wants to buy 100 shares of Stock X and their brokerage uses the same middleman for order flow, the company in the middle could intercept the trade, route the trade on its own and capture a small profit. This order never goes through a major stock exchange. The middle company shares a portion of that profit with the participating brokerages that put your trade into their system.

As you can probably tell, this present a potential conflict of interest. This is because with PFOF, your broker is receiving compensation for routing your order to a specific market maker, which might not always be in your best interest.

Invest in real estate without the headache of being a landlord

Imagine owning a portfolio of thousands of well-managed single family rentals or a collection of cutting-edge industrial warehouses. You can now gain access to a $1B portfolio of income-producing real estate assets designed to deliver long-term growth from the comforts of your couch.

The best part? You don’t have to be a millionaire and can start investing in minutes.

Learn MoreHistory of payment for order flow

Payment for order flow traces its roots to an infamous name in investing: Bernie Madoff. Madoff pioneered this system as a way for large market makers to profit from trade activity. At one point, Madoff’s firm was paying to take about 10% of volume from the New York Stock Exchange. That’s massive — and the influence of just one firm.

Today, major firms including Citadel Securities and Virtu Americas are big players in the PFOF business. When brokerages stopped charging high commissions for executing trades, payment for order flow became a lucrative option to make up for lost revenue.

Payment for order flow takes place at many “free” and discount brokerages. Because of controversies surrounding the practice, some brokerages like Public, don’t participate in this. Others, like Robinhood, rely on this practice as a major part of their business model.

How does payment for order flow work?

Let’s dig in deeper to how payment for order flow works so you can understand where the money goes, how it impacts you and why it’s lucrative for investment firms.

As an example, imagine you want to sell 100 shares of Starbucks and the current market price is $100 per share. You grab your phone, tap a few buttons and enter a market order to sell your shares.

Rather than go right to the NASDAQ to execute the trade, it’s intercepted by Citadel, a major pay for order flow firm. At the same moment you enter your trade, the market price moves to $99.99 per share and someone else enters a limit order to buy 100 shares at $100.01 per share.

Citadel notices this seconds-long discrepancy in the market. It sends your trade to fulfill the limit order at $100.01 per share and fulfills your order at the market price of $99.99. That’s a two-cent spread per share worth $2 total for this trade. Citadel keeps the $2 and sends part to your brokerage as payment for order flow.

Depending on your brokerage’s timing, you may also see a small price improvement on your order so you get a small bit of the profit. However, the CFA Institute equates this to paying a dollar to get a penny back. Generally, payment for order flow is a completely invisible process that could happen to almost all of your stock orders without your knowledge.

Further reading: How to protect your investments

Maximize Your Savings

Discover the best option for your financial future. Whether you’re looking for higher returns or easy access to your cash, compare the benefits of CDs and savings accounts to find the right fit for your goals.

Learn MoreHow high-frequency firms profit from PFOF

The $2 profit in the section above doesn’t sound like a lot, but imagine that the same process happens several million or billion times per day. All of a sudden, that pile of $2 here and $0.20 there turns into millions or billions of dollars to be split up between payment for order flow firms and participating brokerages that send trades.

If you watched Superman 3 or Office Space, you know that fractions of a penny can add up to a high income over time. With PFOF, high-frequency trading firms and brokerages all play in a system that divvies up fractions of a cent for business profits. But when someone is winning by taking advantage of high-speed trading and payment for order flow, someone else is stuck paying the bill.

Why is payment for order flow controversial?

The big controversy around this practice comes from retail consumers like you and me. In the example above with Starbucks stock, the two individual traders buying and selling 100 shares are the losers who wind up giving away $2 that one of them should have arguably been able to keep.

Instead, that $2 is split up between the brokerage and payment for order flow firm. And most consumers have no idea this is happening. So while investment apps like Robinhood and various full-service brokers may appear to be “free” on the surface, you may be paying in another way that doesn’t involve traditional commission.

The SEC requires brokers to disclose that they use payment for order flow when you open an account. Brokers must also send reports regarding their net payments from market makers and the rate of payment for order flow. And in some cases, brokers get a slap on the wrist for not disclosing this revenue source clearly enough, like when the SEC fined Robinhood $65 million. But for the most part, everyday investors don't really know or notice how much money they lose to this business practice.

Because of this potential to exploit the little guy, countries such as Canada have completely banned payment for order flow while others are reviewing the practice. While market makers have some rules and regulations that require them to give traders a reasonable deal based on real market rates, there is plenty of room to earn slivers of a profit by taking advantage of unaware individual investors.

How to avoid payment for order flow

If you sign up for a brokerage firm that offers commission-free trading,

there’s a good chance your orders are subject to payment for order flow.

The only way to avoid this practice is to pick a brokerage that doesn’t participate or gives you the option to opt out.

Public is one of the more popular investing apps that relies on tips to make money instead of payment for order flow. This is one reason people often choose Public over Robinhood or other similar trading apps.

Of course, it could be worth paying a small amount, even with this practice, to enjoy the best brokerage experience for your needs. If one brokerage offers an amazing service and requires this practice, it could still be a better choice than a brokerage that doesn’t use PFOF but provides sub-standard tools and resources.

If you are set against getting caught up in payment for order flow, read the fine print on your brokerage website and any other broker you’re considering. The practice is widespread, and you may have to do a little legwork to find a brokerage that sends every order directly to the market.

Is payment for order flow a good practice?

This practice is a good idea for the brokerages and trading firms that profit from the practice. And some investors argue that smaller brokers can provide better service to customers by routing excess orders to market makers to make things running smoothly. And, theoretically, brokers could pass on some of their PFOF profits to customers with lower fees and perks.

However, for most individual investors, it isn’t a good thing. Payment for order flow introduces conflicts of interest that ultimately have the potential to cost you money. And the worst part is that these fees are hard to detect, even though the SEC requires brokers to disclose their policies surrounding payment for order flow practices.

But because it’s so common and tough to avoid, you may be stuck with it while regulators and firms duke out the details.

Sponsored

Follow These Steps if you Want to Retire Early

Secure your financial future with a tailored plan to maximize investments, navigate taxes, and retire comfortably.

Advisor is an online platform that can match you with a network of vetted fiduciary advisors who are evaluated based on their credentials, education, experience, and pricing. The best part? - there is no fee to find an advisor.